Planning a trip to Los Cabos, Mexico, with your laptop and iPad in tow? While packing for work and leisure may seem harmless, you could set yourself up for an unexpected customs tax. Mexico has strict limits on what travelers can bring into the country tax-free, and having multiple personal electronics could result in a surprise bill upon arrival. It doesn’t matter if one is a work laptop or a personal laptop – they see this as two personal items in your custody.

What are Mexican import fees for laptops and iPads when entering Los Cabos?

When entering Los Cabos or any part of Mexico, Mexican customs regulations allow tourists to bring one portable computing device, such as a laptop, notebook, or iPad, tax-free. However, if you bring more than one of these devices, you may be subject to import duties.

The import fee (duty) for additional electronics, like a second laptop or iPad, is typically 19% of the item’s estimated value. Customs officials may calculate this based on the value they assess for the device, which could vary depending on its condition, brand, and market price. In some reported cases, import duties have exceeded this percentage, sometimes reaching 30-50% or more if the customs officer assigns a higher value to the item.

For example:

- If your second device is valued at $1,000 USD, you could be charged a $190 USD or more duty.

- Higher-end devices, such as a new MacBook or iPad Pro, could result in even larger fees, sometimes reaching several hundred dollars.

You’ll be forced to pay your tax immediately or surrender your device to Mexican Customs to avoid paying any tax. So, no, you won’t get it back when you depart.

Mexico’s Customs Regulations for Electronics

Tax on laptops and iPads in Mexico

According to the Mexican Customs Form, every traveler can bring in one portable computing device without incurring an import fee. This includes a laptop, notebook, or similar device. However, if you’re traveling and bringing a laptop and an iPad to Mexico, this could cause issues, as each is considered a separate device. Here’s the breakdown:

- Allowed: 1 laptop or similar portable computing device (e.g., iPad)

- Limited: 3 cell phones, 1 GPS, 2 cameras, 1 pair of binoculars, 4 fishing poles

The key is to ensure you stay within these limits to avoid paying customs duties on additional items. For electronics, any item beyond these allowances will be taxed at 19% of its estimated value, though some cases report duties as high as 200%.

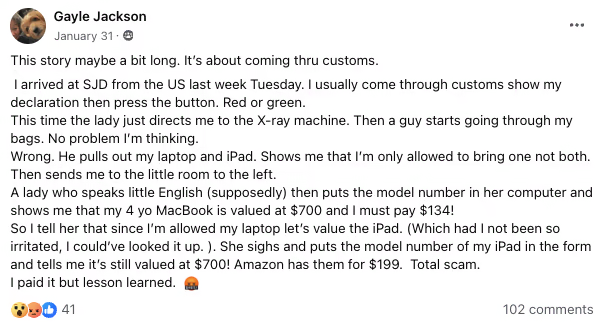

Case Studies of Fines and Confiscations

Tourists traveling to Mexico, especially Los Cabos, have shared stories online about being fined for carrying extra gadgets. One traveler reported being charged over $300 for a second laptop, despite claiming it was for personal use. Another traveler’s iPad was nearly confiscated at the airport when customs officers determined it exceeded the number of allowable devices. Both cases caused delays in entering the country, turning what should’ve been a smooth vacation into a frustrating ordeal.

Tips to Avoid Customs Fees in Los Cabos

Keep Electronics Separate Among Travelers

If you’re traveling with family or friends, the easiest way to avoid exceeding the customs limits is to distribute electronics among your group. Everyone can bring one laptop or tablet, so make sure these items are in separate bags each individual carries. For example, if you and your partner carry an iPad and a laptop, keep your devices in separate luggage to avoid suspicion and additional Mexican Customs tax import charges.

Why Packing Together Could Be a Mistake

While it might be tempting to pack all your electronics in one suitcase for convenience, customs officers may interpret this as belonging to one person, even if you’re traveling as a group. This could result in the additional items being taxed or even confiscated. It’s best to pack and carry your electronics separately to stay within the allowed limits.

Handling Customs Inspections in Los Cabos

What Happens if You’re Stopped

If a customs officer flags your bag for inspection and discovers multiple electronic devices, they will calculate the duty based on the item’s estimated value. This process can be time-consuming and stressful, often delaying your entry into the country. Additionally, you may have to provide proof of purchase or be at the mercy of the customs officer’s valuation, which can vary widely.

Unexpected Fees That Add Up

The duty on extra electronics can vary depending on the value of the item and the discretion of the customs officer. For example, a traveler with a brand new MacBook Pro reported being taxed over 30% of the value, turning what should’ve been a 19% duty into a whopping $600 fee. To avoid these kinds of surprises, ensure you’re familiar with the limits and pack accordingly.

How Mexican Customs Determines the Value of Items

When customs officers need to assess the value of your electronic devices, they may ask for receipts or inspect the item for its current condition. Newer electronics or high-end devices like Apple products often receive higher valuations, leading to steeper import duties. In some cases, if you cannot provide proof of the item’s purchase price, officers might rely on market estimates, which are often higher than expected.

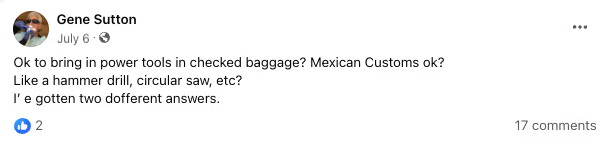

Electronics

- One laptop or notebook per person.

- One camera or video camera (excluding professional equipment).

- Three cell phones.

- One GPS device.

- Two personal cameras or camcorders.

- One set of binoculars.

- One tablet, e-reader, or other handheld electronic device.

- One set of portable speakers.

- Two musical instruments.

2. Clothing and Personal Items

- Personal clothing, shoes, and hygiene products for personal use.

- Two sets of sporting equipment (e.g., tennis rackets, golf clubs).

- One tent and camping equipment.

- Up to 10 DVDs or Blurays and five video game consoles or cartridges.

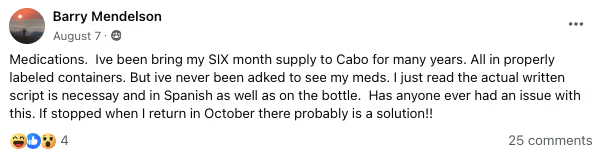

3. Medication

- Personal medications as long as they are for the traveler’s use and do not exceed the legal quantity.

- If carrying controlled substances, a prescription must be provided.

4. Sports and Outdoor Gear

- Four fishing rods (per person).

- One surfboard or windsurfing board.

- Two sets of skis or similar sporting equipment.

5. Food, Beverages, and Alcohol

- Up to three liters of alcohol (e.g., wine, beer, or spirits).

- Up to six liters of wine.

- Tobacco: Up to 10 packs of cigarettes, 25 cigars, or 200 grams of loose tobacco.

6. Cash and Monetary Instruments

- You may bring up to $10,000 USD or its equivalent in other currencies. Amounts above this must be declared.

7. Gifts and Souvenirs

- Up to $500 USD in goods purchased abroad can be brought in without paying duty.

8. Additional Rules

- Pets: Cats, dogs, and other common pets are allowed if you provide the proper vaccination certificates.

- Prohibited items: Certain weapons, narcotics, and illegal substances are strictly forbidden.

- Cultural artifacts and antiques: Exportation or importation of culturally significant items is restricted.

9. Exemptions for Families

If you’re traveling as a family (parents and children), the allowances for items such as electronics and sports equipment do not accumulate. Each individual is treated separately, so family members must carry their items to avoid combining them and exceeding the allowable limits.

10. Import Fees and Duties

- Items beyond the allowed personal limits may be subject to an import duty of 19% of their estimated value.

- In some cases, the duty may be higher, depending on how customs officials assess the value of the goods.

Additional Tips:

- If you are carrying goods that might be questioned by customs, it’s recommended to keep receipts or documentation to verify their value.

- Customs officers may inspect your luggage and belongings to ensure compliance with these regulations.

Tips for a Smooth Arrival in Los Cabos

- Separate Electronics: Distribute laptops, iPads, and other gadgets among your traveling companions.

- Check Gadget Limits: Before your trip, review the Mexican Customs Form to make sure you’re within the allowed number of electronics.

- Be Prepared for Inspection: If you’re stopped, stay calm and have receipts or proof of purchase ready to avoid inflated valuations.

- Pack Light: Consider leaving one of your devices at home to avoid potential hassles at customs.

Being mindful is worth more money in your wallet. Don’t let Mexico’s customs regulations affect your trip to Los Cabos with any unexpected customs drama. Bringing your work devices along to Los Cabos is often necessary in the age of remote work, but make sure to follow Mexican customs regulations to avoid paying hefty import fees. Simple strategies, such as separating your electronics or packing light, can help you breeze through customs and enjoy your vacation without any interruptions.